ist-pasion.com – The advent of fintech has significantly reshaped the landscape of traditional banking, introducing new technologies and business models that have both challenged and complemented existing practices. This transformation is multifaceted, affecting various aspects of banking operations, customer service, and market dynamics.

Key Features and Innovations

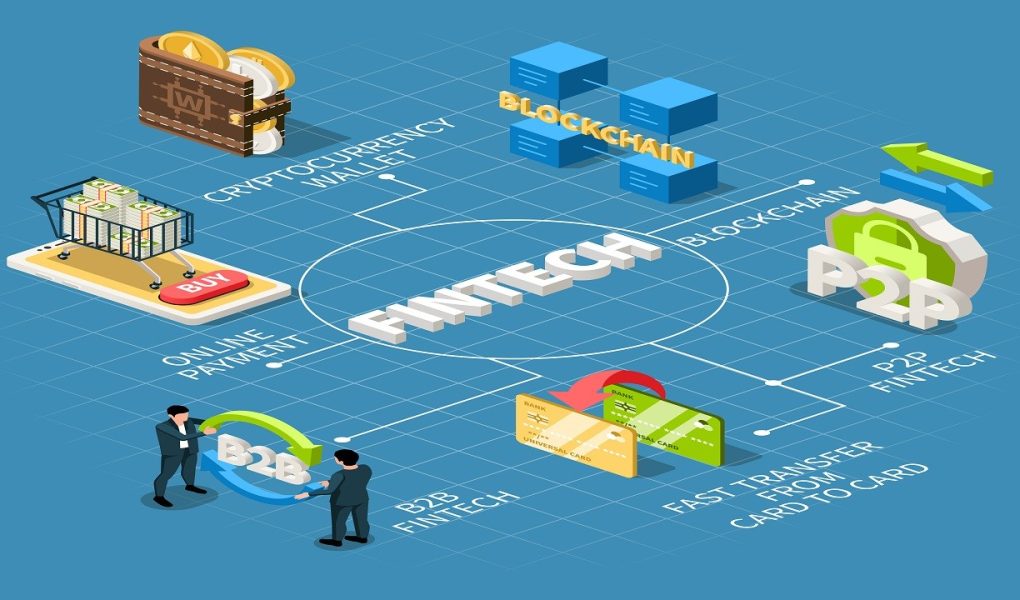

Fintech companies have leveraged cutting-edge technologies such as artificial intelligence, blockchain, and big data analytics to offer innovative financial services. These include mobile banking apps, peer-to-peer lending platforms, and cryptocurrency exchanges, which have made financial transactions more accessible and efficient.

Collaboration and Competition

The relationship between fintech and traditional banks is complex, characterized by both collaboration and competition. Many traditional banks have partnered with fintech firms to enhance their digital offerings and improve customer experience. This collaboration has led to the development of new products and services that combine the strengths of both sectors.

Regulatory Challenges

The rapid growth of fintech has also brought about regulatory challenges. Governments and financial regulators are grappling with how to oversee these new financial entities while ensuring consumer protection and maintaining financial stability. This has led to the development of new regulatory frameworks and guidelines.

Impact on Traditional Banking

The impact of fintech on traditional banking is profound and multifaceted. On one hand, fintech has forced traditional banks to accelerate their digital transformation, enhancing their service offerings and operational efficiency. On the other hand, it has intensified competition, particularly in areas such as retail banking and payments, leading to a more dynamic and competitive financial services market.

Future Outlook

Looking ahead, the integration of fintech and traditional banking is expected to continue, with both sectors benefiting from the synergies created by their collaboration. The future of banking will likely see a more seamless blend of traditional services with innovative fintech solutions, leading to enhanced customer experiences and more efficient financial systems312.

In conclusion, the impact of fintech on traditional banking is a testament to the transformative power of technology in financial services. As the two sectors continue to evolve together, the financial landscape will become more dynamic, efficient, and customer-centric.